Card Blanch

Invest Now

Raised

$0

Days Left

Closed

Business Description

Highlights:

– We enable users to utilize all their bank cards and loyalty programs all in one place

– Card payments represent a $10 Trillion market opportunity

– Highly experienced FinTech team

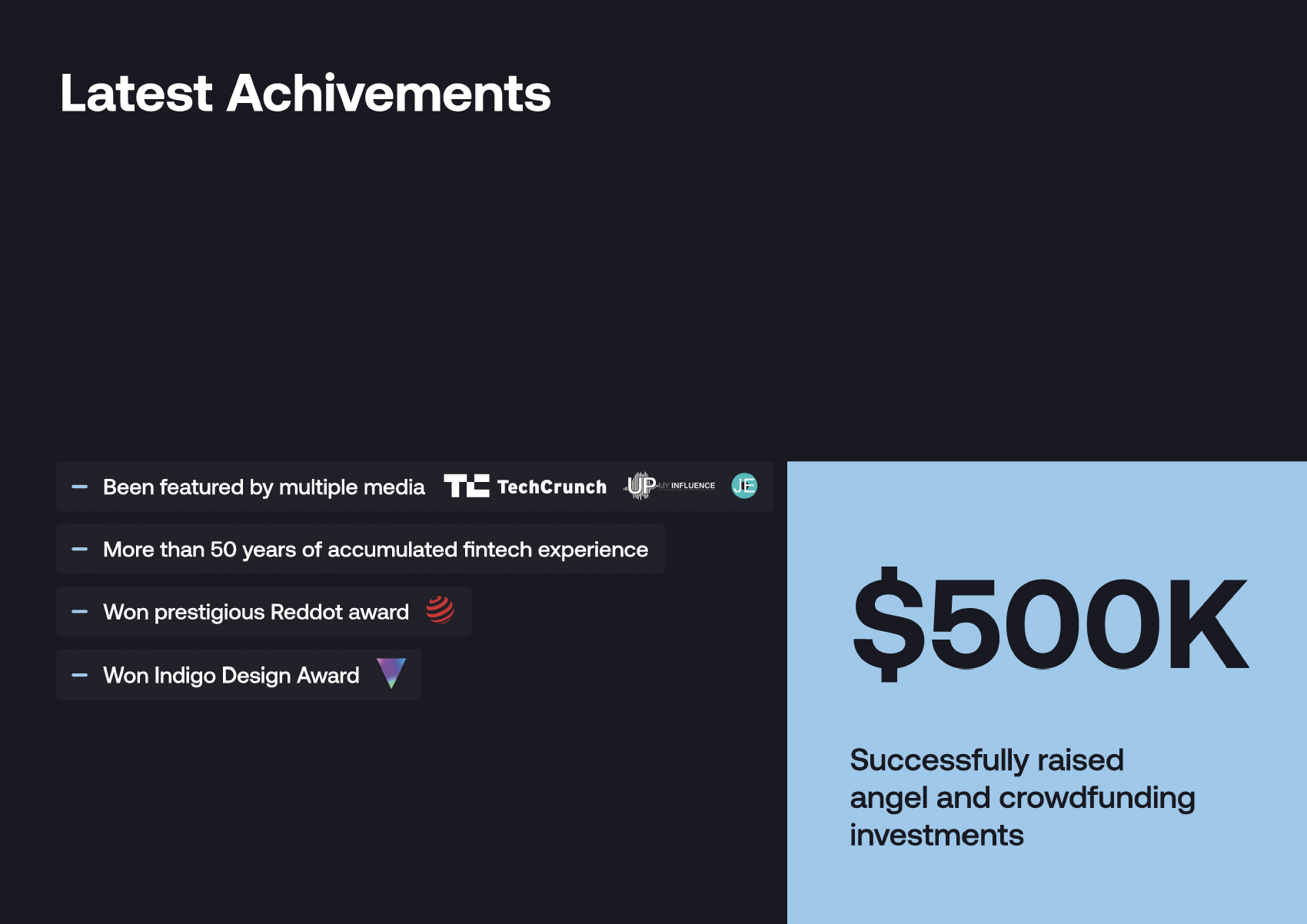

– Card Blanch is a Serial RedDot award winner and backed by experts in fintech banking

– Featured on TechCrunch, Yahoo Finance, International Business Times, and more

– Successfully raised $500K of angel and crowdfunding investment

Overview:

Card Blanch is at the forefront of reshaping the future of financial management and shopping experiences. With our innovative platform, we consolidate credit and debit cards and loyalty programs, into a single, user-friendly space. By harnessing the power of AI, we offer invaluable spending insights and discount opportunities, all accessible through a singular card.

At Card Blanch, we envision a world where financial management is streamlined, convenient, and intelligent. Our mission is to empower individuals to take complete control of their financial lives by managing traditional bank cards and leveraging loyalty program benefits. We believe that by uniting these financial elements under a single, AI-powered platform, we can simplify the complex, unlock hidden value, and usher in a new era of seamless shopping experiences.

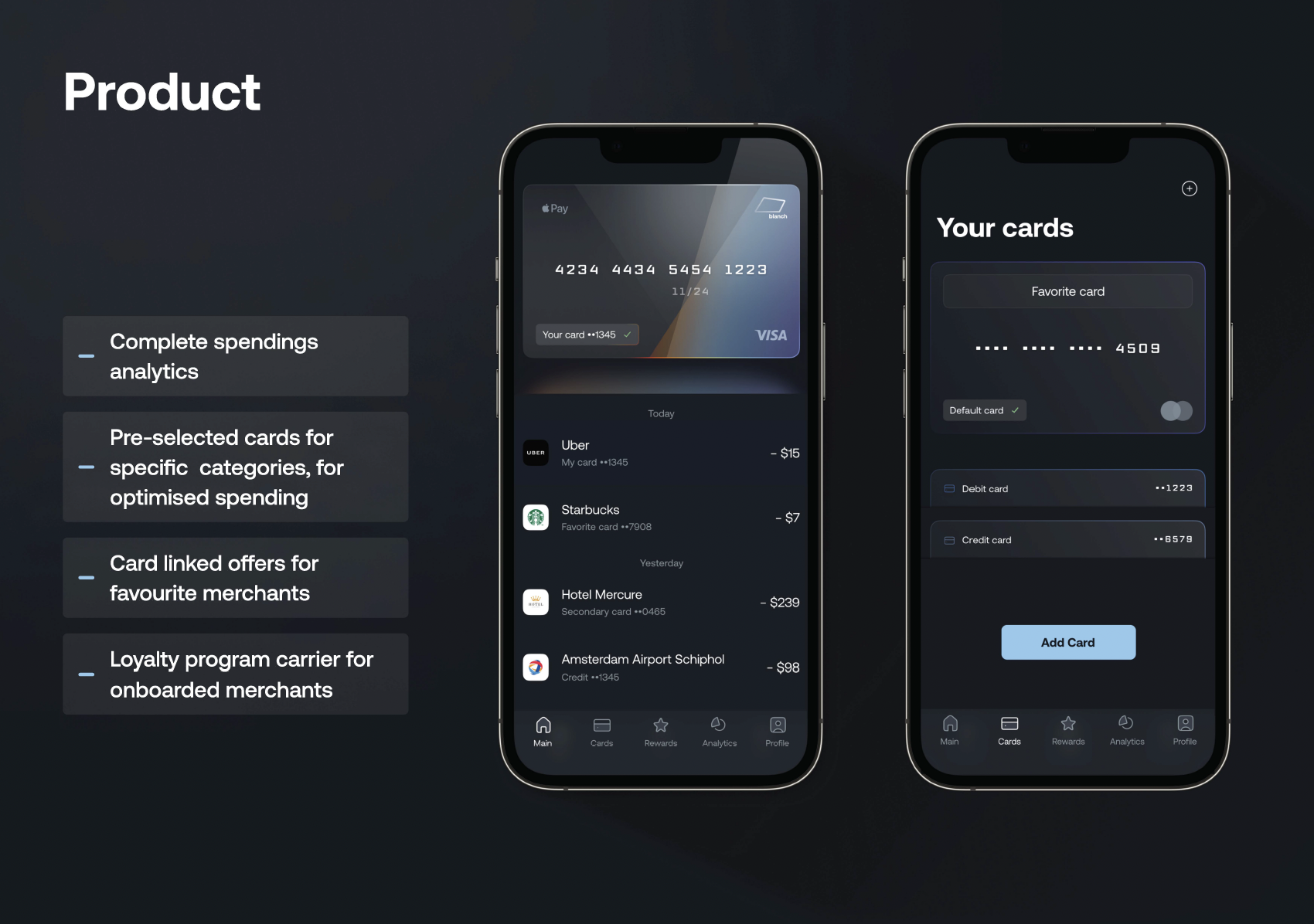

Key Features:

1. Streamlined Convenience: We eliminate the need for multiple apps and platforms, providing a centralized space for financial control.

2. AI-Driven Intelligence: Our AI-powered insights empower users with actionable information, transforming how they approach spending and saving.

3. Splitpay tech: Our splitpay technology enables users to split their big purchases between connected cards.

Card Blanch is more than a platform; it’s a movement towards smarter shopping. We are driving a transformative shift in how individuals use their financial resources, embracing the power of AI. Together, we are reshaping the way people engage with their finances, making every transaction an opportunity for savings and empowerment. Welcome to a world where financial strength unites in one space – welcome to Card Blanch.

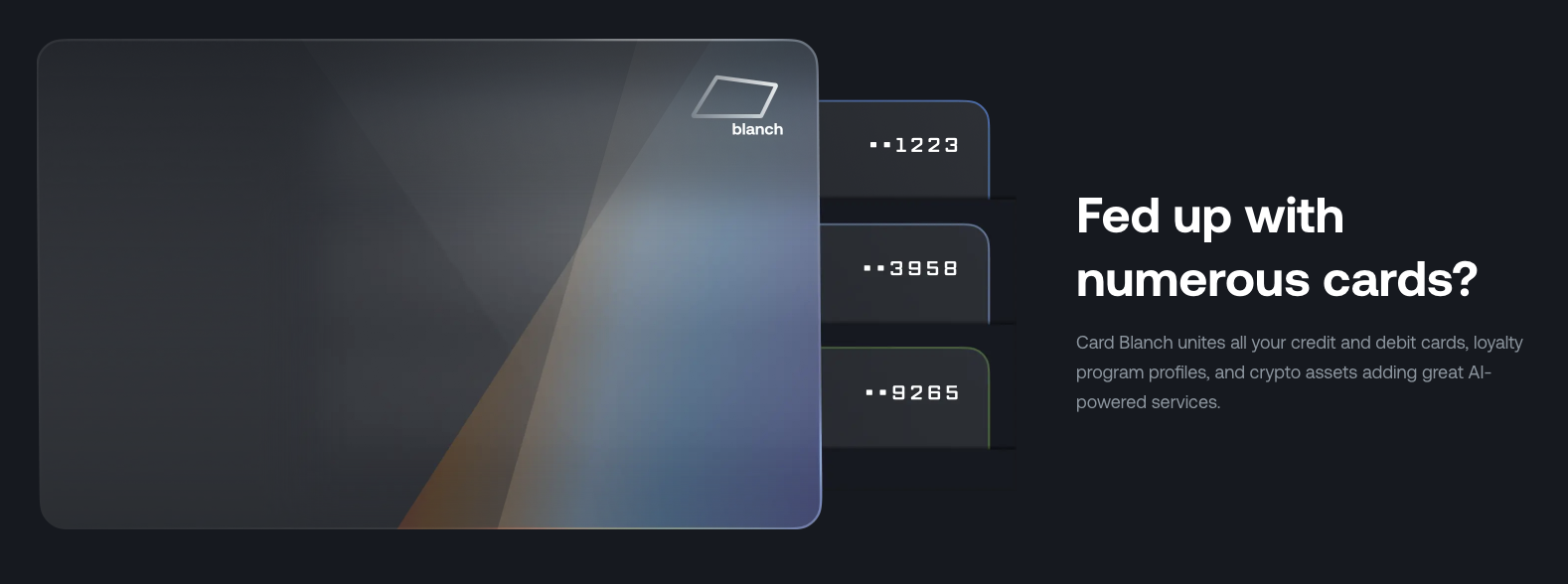

Problem

In today’s rapidly evolving financial landscape, individuals are grappling with the complexities of managing their financial resources effectively. Traditional methods of handling bank cards, loyalty programs, and the emergence of cryptocurrencies have introduced challenges that demand innovative solutions. This is where Card Blanch steps in.

1. Fragmented Financial Landscape: The average individual carries multiple credit and debit cards, each serving different purposes such as travel, dining, or shopping. Juggling these cards, remembering PINs, and knowing which card to use where creates unnecessary confusion and hassle. This fragmented approach to financial management hinders convenience and efficiency.

2. Loyalty Program Complexity: Loyalty programs, designed to reward customer loyalty, often come from various brands and businesses. These programs frequently have distinct rules, redemption methods, and expiration dates. As a result, users struggle to maximize the benefits of these programs, missing out on potential savings and perks.

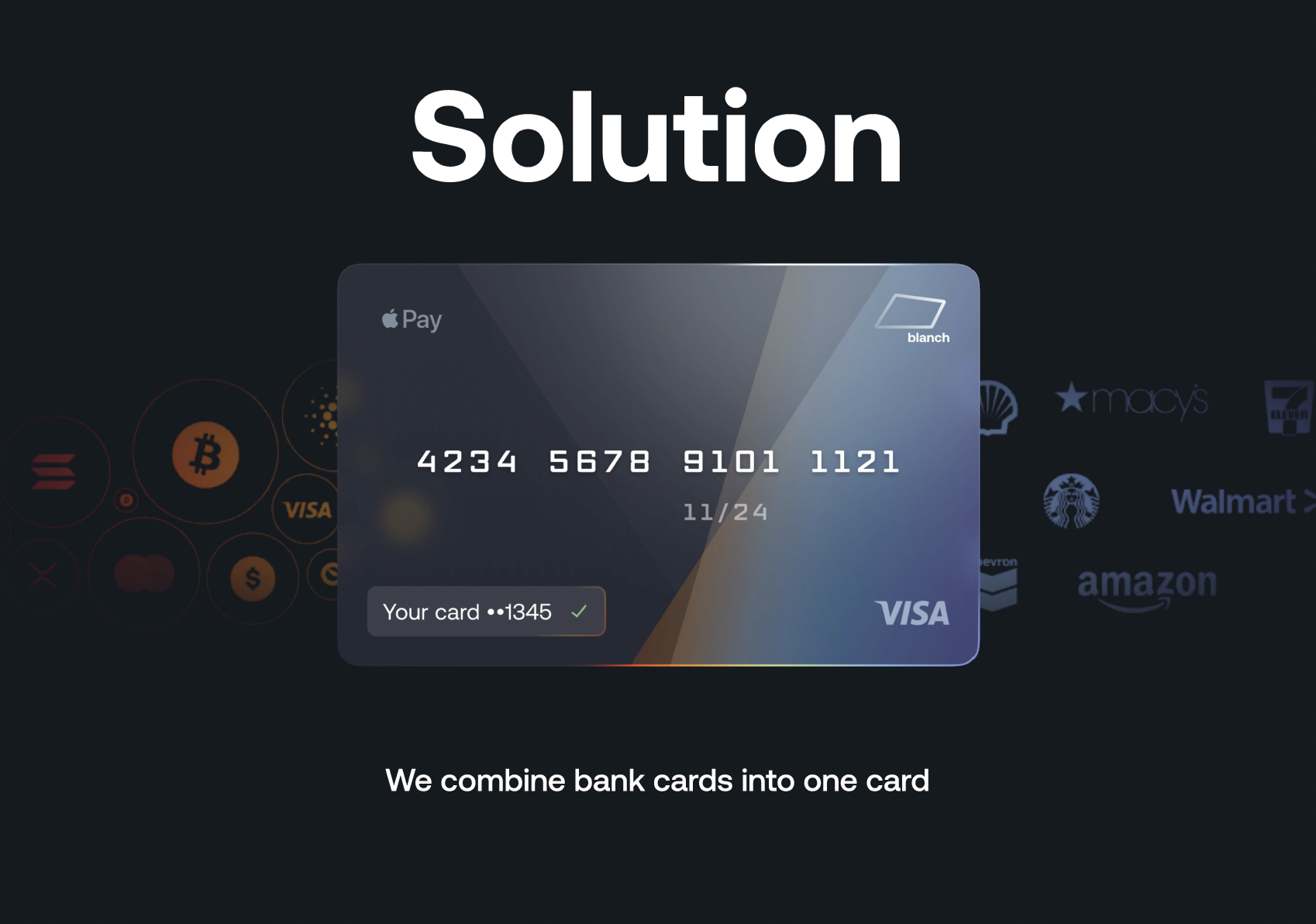

Solution

Card Blanch addresses these pain points by providing a unified platform that consolidates all financial aspects into a single, convenient space. Our AI-powered services offer spending insights and discount opportunities, ensuring users make informed financial decisions. By offering a singular card to access and manage financial resources, Card Blanch empowers users to regain control over their finances, streamline loyalty program benefits, and seamlessly adapt to the evolving shopping landscape.

With our smart SplitPay © technology, users can better utilize available funds, e.g., make bigger purchases by Card Blanch, covering it with multiple cards. You will still enjoy your cashback and other benefits programs from connected cards while paying for different categories like gas, utilities, groceries, and beyond. Card Blanch is poised to redefine how individuals manage their financial resources, offering them unprecedented control, convenience, and confidence.

Using algorithms, we can automatically apply the best card and currency for a particular transaction, as well as apply rewards and discount opportunities. Card Blanch then adapts all your financial acts to the credit score optimization plan raising your creditworthiness to the highest limits.

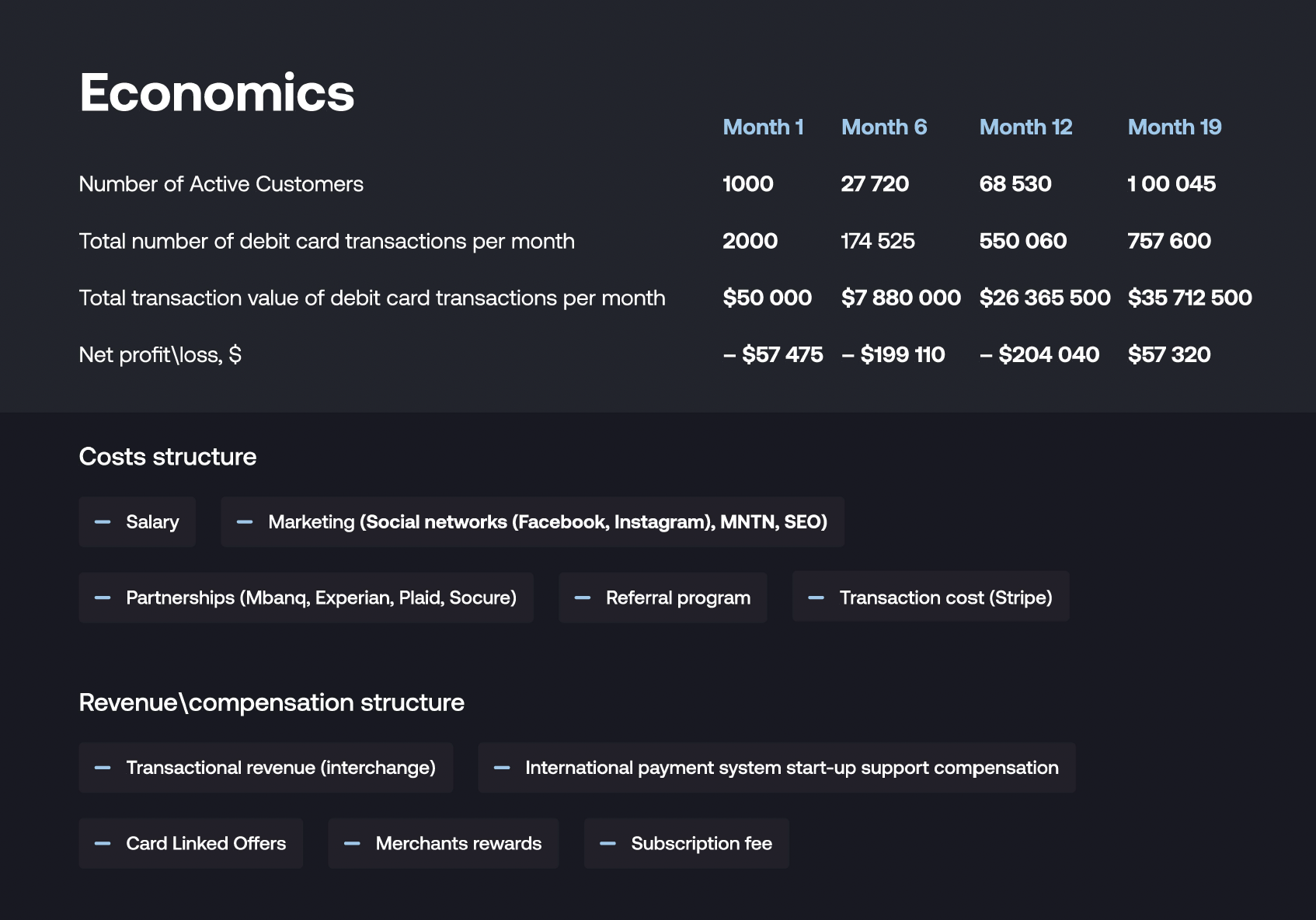

Business Model

Card Blanch operates on a multifaceted business model that aligns with our mission to provide users with a streamlined and rewarding financial management experience. Our model combines user subscriptions, merchant partnerships, cash-back incentives, and interchange fees to create a sustainable ecosystem that benefits both users and stakeholders.

1. User Subscriptions:

Card Blanch offers tiered subscription plans that cater to various user needs and preferences. These subscription plans grant users access to a range of premium features, including AI-powered payments, discount opportunities and credit score optimization. Subscriptions ensure a recurring revenue stream that fuels ongoing platform development and user support.

2. Merchant Partnerships:

We collaborate with a network of merchant partners to offer exclusive discounts and rewards opportunities to our users. Through these partnerships, Card Blanch becomes a valuable channel for merchants to reach a targeted audience and boost sales. Merchants may contribute a portion of the revenue generated from transactions facilitated through our platform, creating a win-win scenario.

3. Cash-Back Incentives and Merchant Rewards:

To enhance user engagement and loyalty, Card Blanch provides cash-back incentives on eligible transactions. We partner with merchants who offer cash-back rewards on purchases made using our platform. Additionally, merchants can leverage our up-sale rewards program, encouraging users to explore a wider range of products and services within their offerings.

4. Interchange Fees:

As users make transactions using their linked bank cards, Card Blanch collects interchange fees – a standard practice in the payment industry. These fees are charged to the merchants for processing transactions and are a significant revenue source for our platform.

5. Premium Services and Add-Ons:

Card Blanch offers premium services and add-ons beyond the basic subscription plans. These additional features cater to users seeking enhanced functionalities or specialized services. By offering value-added services, we create upselling opportunities that further contribute to our revenue streams.

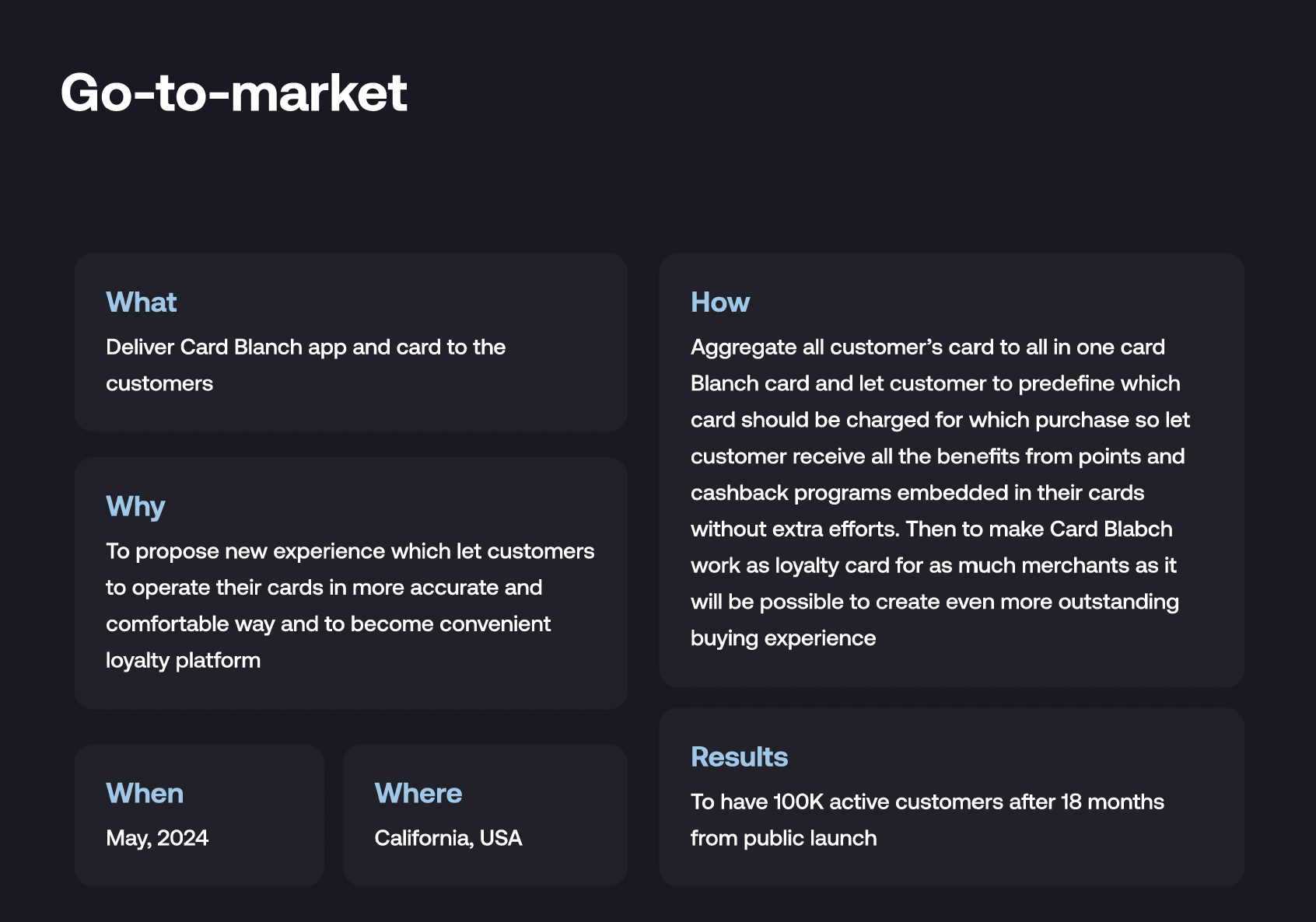

Market Projection

With Fintech and Crypto on the rise, we believe to have a $10T market opportunity.

Card Blanch is positioned to tap into the thriving fintech market, transforming the way individuals manage their finances, engage with loyalty programs, and embrace the rise of cryptocurrencies. As the financial landscape continues to evolve, our innovative platform addresses critical pain points, positioning us for substantial growth over the next 3-5 years. With that, our US target market is 177 Million cardholders, with $144 Billion in purchase transactions projected by 2025

With a compelling value proposition, strategic market positioning, and an innovative suite of features, Card Blanch is poised to capitalize on the rising demand for fintech solutions that bridge traditional finance and the cryptocurrency revolution. Our market projections reflect our commitment to driving user adoption, merchant engagement, and revenue growth while transforming how people shop and manage their financial lives.

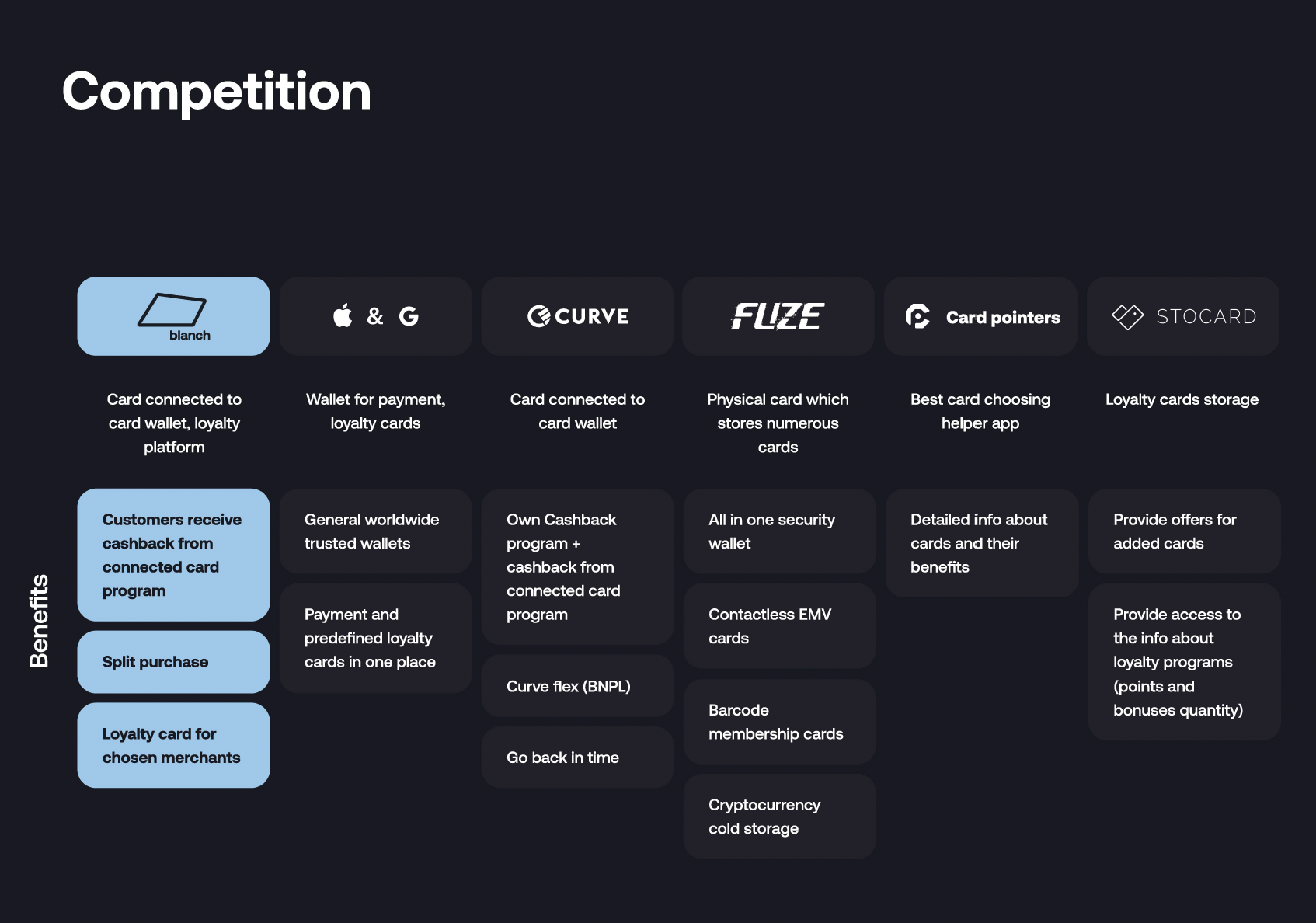

Competition

While the fintech landscape is evolving, Card Blanch stands out due to its comprehensive and user-centric approach. In contrast to other solutions, we offer a unique value proposition that combines:

Unified Financial Management: Unlike competitors, Card Blanch seamlessly integrates bank cards, loyalty programs, and crypto assets under one platform, streamlining financial management for users.

AI-Powered Services: Our AI algorithms provide personalized spending insights and optimized card selections, enhancing users’ decision-making processes.

Discounts and Rewards: Card Blanch not only simplifies finances but also empowers users with real-time discounts, cash-back rewards, and exclusive merchant partnerships.

Credit Score Optimization: Our platform actively adapts financial activities to boost creditworthiness, setting us apart as a holistic financial empowerment tool.

Card Blanch’s unique combination of features sets us apart by redefining how users interact with their finances, making us a trailblazer in the industry. Our holistic approach, AI-powered insights, discounts, rewards, and AI integration differentiate us from the competition, providing users with an unparalleled all-in-one financial management solution.

Traction & Customers

Card Blanch has experienced significant traction and momentum, both in terms of user acquisition and strategic partnerships. Our innovative platform’s ability to simplify financial management and enhance shopping experiences has resonated with users, while our collaborative approach with banks and merchants has laid a solid foundation for growth.

Having already established partnerships with over 20 top European and international banks – we understood that people are not seeking new banks. They are seeking better use of their current ones. This is how we came up with the idea of Card Blanch, and we believe we are on track to address these needs in the US market.

Here’s more on our roadmap and Future Growth Prospects:

Entering the US Market: Our target audience of 177 million cardholders and the projected $144 billion in purchase transactions by 2025 present a significant growth opportunity.

Fintech Demand: As the fintech sector evolves we anticipate a surge in demand for solutions that seamlessly manage . Card Blanch is positioned to capture this demand with our unified platform.

Continued Innovation: Our roadmap includes ongoing enhancements to our AI algorithms, integrations with merchants, and credit score optimization features. These innovations will further solidify our position as a leading fintech solution provider.

Investors

Card Blanch has performed two previous exempt offerings.

April 2022: Card Blanch raised $1,019,665 through Regulation Crowdfunding.

Card Blanch’s next step is to raise $618k in this seed round. They intend to use the raised funds to create their patent portfolio, launch their MVP product, receive early adopters’ feedback, and launch an aggressive marketing campaign.

Terms

Card Blanch Inc. is offering securities in the form of Simple Agreements for Future Equity (“SAFE”), which provides investors the right to preferred stock in the Company (“Preferred Stock”), when and if the Company sponsors an equity offering that involves Preferred Stock, on the standard terms offered to other investors.

SAFE: $6M Post Money Valuation Cap

Discount Rate: 60%

Target Offering: $10,000 | 10,000 Securities

Maximum Offering Amount: $618,000 | 618,000 Securities

Type of Security: SAFE

Offering Deadline: April 1, 2024

Minimum Investment: $300

Conversion to Preferred Equity: Based on SAFE, when Card Blanch engages in an offering of equity interests involving preferred stock, Investors will receive a number of shares of preferred stock calculated using the method that results in the greater number of preferred stock:

The total value of the investors investment divided by:

(i) The price of preferred stock issued to new investors multiplied by the discount rate (60%), or if the valuation for the company is more than $6,000,000 (the “Valuation Cap”), (ii) the amount invested by the investor divided by the quotient of the Valuation Cap divided by the total amount of the Company’s capitalization at that time.

Additional Terms of the Valuation Cap: For purposes of (ii) above, the Company’s capitalization calculated as of immediately prior to the Equity Financing and (without double-counting, in each case calculated on an as-converted to Common Stock basis):

- Includes all shares of Capital Stock issued and outstanding

- Includes all Converting Securities

- Includes all (i) issued and outstanding Options and (ii) Promised Options; and

- Includes the Unissued Option Pool, except that any increase to the Unissued Option Pool in connection with the Equity Financing shall only be included to the extent that the number of Promised Options exceeds the Unissued Option Pool prior to such increase.

Liquidity Events: If the Company has an initial public offering or is acquired by, merged with or otherwise taken over by another company or new owners prior to Investors in the SAFEs receiving preferred stock, Investors will receive proceeds equal to the greater of (i) the Purchase Amount (the “Cash-Out Amount”) or (ii) the amount payable on the number of shares of Common Stock equal to the Purchase Amount divided by the Liquidity Price (the “Conversion Amount”).

Liquidity Priority: In a Liquidity Event or Dissolution Event, the SAFE is intended to operate like standard nonparticipating Preferred Stock. The Investor’s right to receive its Cash-Out Amount is:

- Junior to payment of outstanding indebtedness and creditor claims, including contractual claims for payment and convertible promissory notes (to the extent such convertible promissory notes are not actually or notionally converted into Capital Stock);

- On par with payments for other SAFEs and/or Preferred Stock, and if the applicable proceeds are insufficient to permit full payments to the Investor and such other SAFEs and/or Preferred Stock, the applicable proceeds will be distributed pro rata to the Investor and such other SAFEs and/or Preferred Stock in proportion to the full payments that would otherwise be due; and

- Senior to payments for Common Stock.

The Minimum Individual Purchase Amount accepted under this Regulation CF Offering is $300. The Company must reach its Target Offering Amount of $10,000 by April 1, 2024 (the “Offering Deadline”). Unless the Company raises at least the Target Offering Amount of $10,000 under the Regulation CF offering by the Offering Deadline, no securities will be sold in this Offering, investment commitments will be cancelled, and committed funds will be returned.

Risks

Card Blanch has the Following Risks:

1.

An investment in the Company (also referred to as “we”, “us”, “our”, or “Company”) involves a high degree of risk and should only be considered by those who can afford the loss of their entire investment. Furthermore, investments should only be undertaken by persons whose financial resources are sufficient to enable them to indefinitely retain an illiquid investment. Each investor in the Company should consider all of the information provided to such potential investor regarding the Company as well as the following risk factors, in addition to the other information listed in the Company’s Form C. The following risk factors are not intended, and shall not be deemed to be, a complete description of the commercial and other risks inherent in the investment in the Company.

2.

The Company, is offering a SAFE in the amount of up to $618,000 in this offering, and may close on any investments that are made. Even if the maximum amount is raised, the Company is likely to need additional funds in the future in order to grow, and if it cannot raise those funds for whatever reason, including reasons relating to the Company itself or the broader economy, it may not survive. If the Company manages to raise only the minimum amount of funds, sought, it will have to find other sources of funding for some of the plans outlined in “Use of Proceeds.” The Company may never receive a future equity financing that results in the conversion of the Securities upon such future financing.

3.

All of our current services are variants on one type of service, providing a platform for online capital formation. Our revenues are therefore dependent upon the market for online capital formation.

4.

The preferred stocks that the SAFE converts into has no voting rights attached to them. You will be part of the minority shareholders of the Company and therefore will have a limited ability to influence management’s decisions on how to run the business. You are trusting in management discretion in making good business decisions that will grow your investments. Furthermore, in the event of a liquidation of our company, you will only be paid out if there is any cash remaining after all of the creditors of our company have been paid out.

5.

Our growth projections are based on an assumption that with an increased advertising and marketing budget our products will be able to gain traction in the market at a faster rate than our current products have. It is possible that our new products will fail to gain market acceptance for any number of reasons. If the new products fail to achieve significant sales and acceptance in the market, this could materially and adversely impact the value of your investment.

6.

One of the Company’s most valuable assets is its intellectual property. The Company’s owns 10 trademarks, copyrights, Internet domain names, and trade secrets. We believe one of the most valuable components of the Company is our intellectual property portfolio. Due to the value, competitors may misappropriate or violate the rights owned by the Company. The Company intends to continue to protect its intellectual property portfolio from such violations. It is important to note that unforeseeable costs associated with such practices may invade the capital of the Company.

7.

To be successful, the Company requires capable people to run its day to day operations. As the Company grows, it will need to attract and hire additional employees in sales, marketing, design, development, operations, finance, legal, human resources and other areas. Depending on the economic environment and the Company’s performance, we may not be able to locate or attract qualified individuals for such positions when we need them. We may also make hiring mistakes, which can be costly in terms of resources spent in recruiting, hiring and investing in the incorrect individual and in the time delay in locating the right employee fit. If we are unable to attract, hire and retain the right talent or make too many hiring mistakes, it is likely our business will suffer from not having the right employees in the right positions at the right time. This would likely adversely impact the value of your investment.

Please be sure to read and review the Offering Statement. A crowdfunding investment involves risk. You should not invest any funds in this offering unless you can afford to lose your entire investment.

In making an investment decision, investors must rely on their examination of the issuer and the terms of the offering, including the merits and risks involved. These securities have not been recommended or approved by any federal or state securities commission or regulatory authority. The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

These securities are offered under an exemption from registration; however, the U.S. Securities and Exchange Commission has not made an independent determination that these securities are exempt from registration.

Neither PicMii Crowdfunding nor any of its directors, officers, employees, representatives, affiliates, or agents shall have any liability whatsoever arising from any error or incompleteness of fact or opinion in, or lack of care in the preparation or publication of, the materials and communication herein or the terms or valuation of any securities offering.

The information contained herein includes forward-looking statements. These statements relate to future events or future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on forward-looking statements since they involve known and unknown risks, uncertainties, and other factors, which are, in some cases, beyond the company’s control and which could, and likely will materially affect actual results, levels of activity, performance, or achievements. Any forward-looking statement reflects the current views with respect to future events and is subject to these and other risks, uncertainties, and assumptions relating to operations, results of operations, growth strategy, and liquidity. No obligation exists to publicly update or revise these forward-looking statements for any reason or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Security Type:

SAFE

Valuation Cap

$6,000,000

Discount Rate

60%

Post Money Valuation:

N/A – SAFE Raise

Investment Bonuses!

None.

Regulatory Exemption:

Regulation Crowdfunding – Section 4(a)(6)

Deadline:

April 1, 2024

Minimum Investment Amount:

$300

Target Offering Range:

$10,000-$618,000

*If the sum of the investment commitments does not equal or exceed the minimum offering amount at the offering deadline, no securities will be sold and investment commitments will be cancelled returned to investors.

Leonid Goriev

Founder and CEO

BackgroundTech entrepreneur. Owner and founder of several tech companies. Expert in software design and development for international banks and fintech.

Artem Loktionov

COO

BackgroundPSM certified leader, 9 years of project management experience, 4+ years of managing complex software development projects for international banks.

Andrii Bohun

CTO

Background18 years in software development in different industries of various complexity. Has solid experience in building banking software for Switzerland.

Company Name

Card Blanch

Location

11 N Market St STE 300

San Jose, California 95113

Number of Employees

10

Incorporation Type

C-Corp

State of Incorporation

DE

Date Founded

May 25, 2021